Social Security Contribution Limit 2025. Maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your earnings. This amount is also commonly referred to as the taxable maximum.

2 any benefit reduction is not “lost.” once full retirement age is attained,. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).

Those limits change from year to year, but in 2025, the base limit is $22,320, up from $21,240 in 2025.

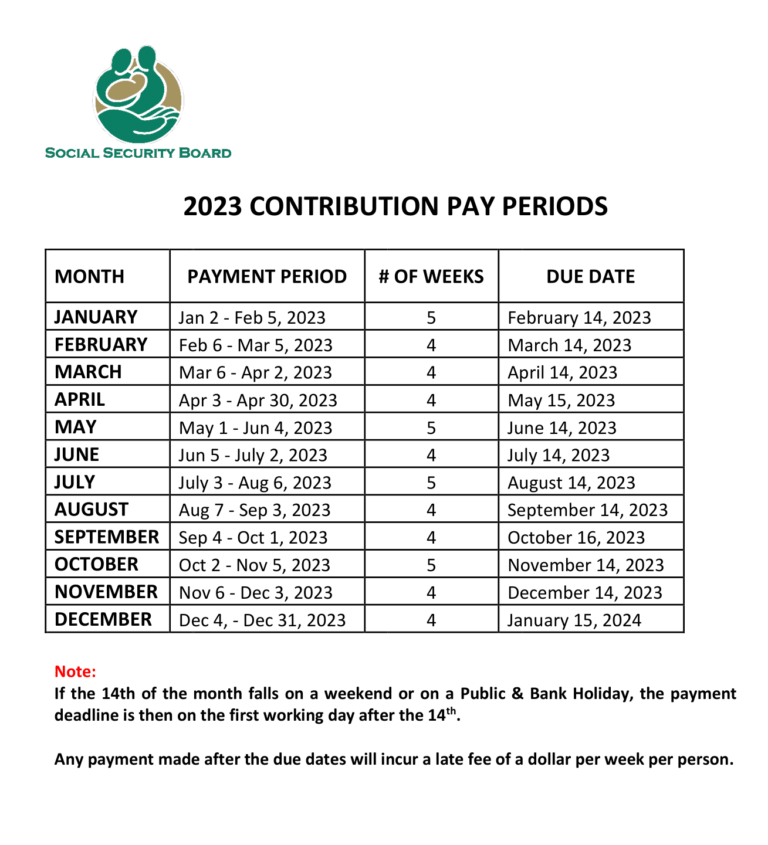

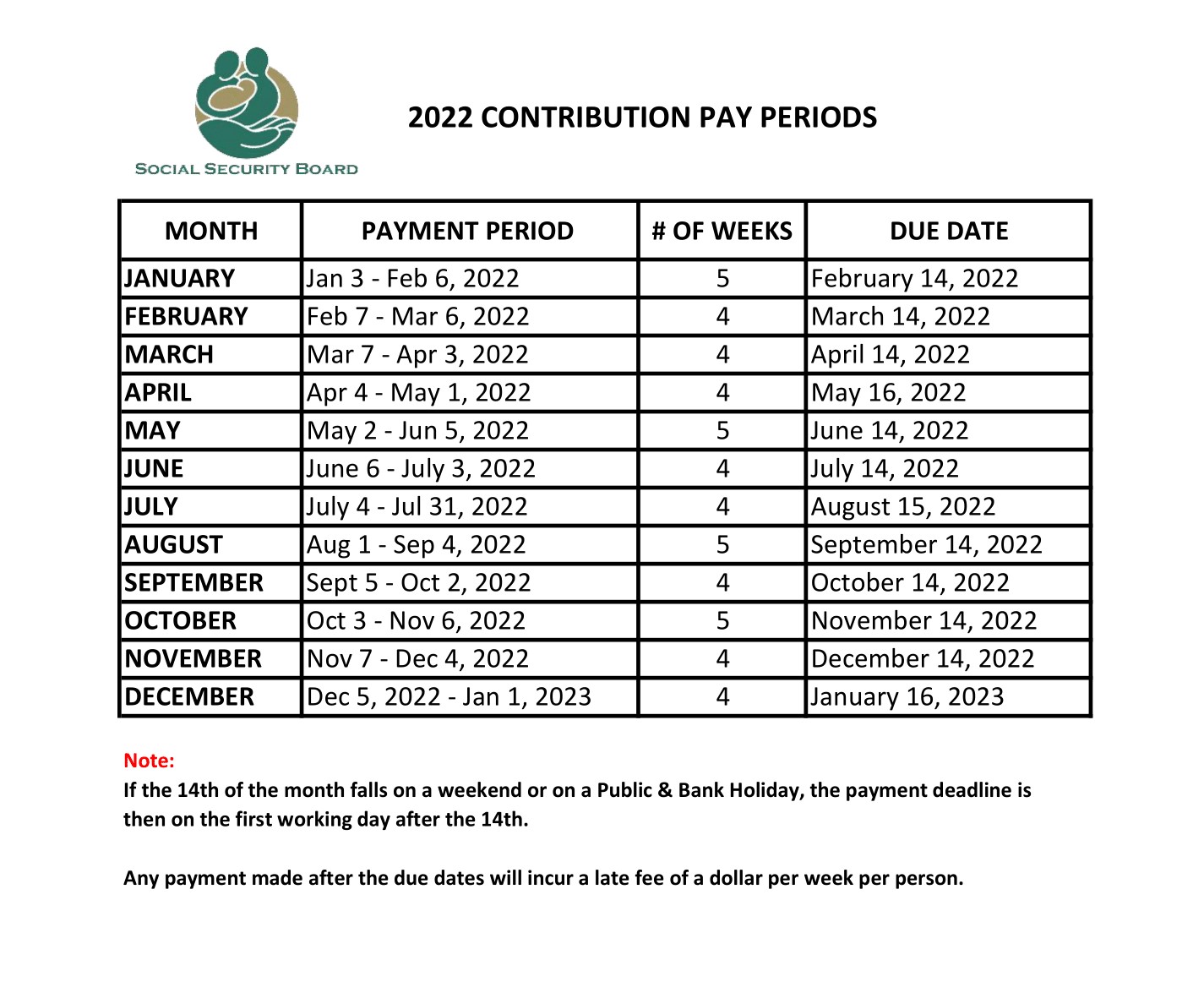

Contribution Due Dates Social Security Board, Belize, 26 mar 2025, 03:42:25 pm ist sensex today live : As a result, in 2025.

Socso Contribution Table 2025 Socso New Avanzo Management Consulting, By law, some numbers change automatically each year to keep up with. During this period, we would withhold $1,160 ($1 for every $3 you earn above the $59,520 limit).

Contribution Due Dates Social Security Board, Belize, During this period, we would withhold $1,160 ($1 for every $3 you earn above the $59,520 limit). He solicited funding from conservative donors, drawing on a $27 million contribution from the bradley impact fund, which had financed a web of groups that.

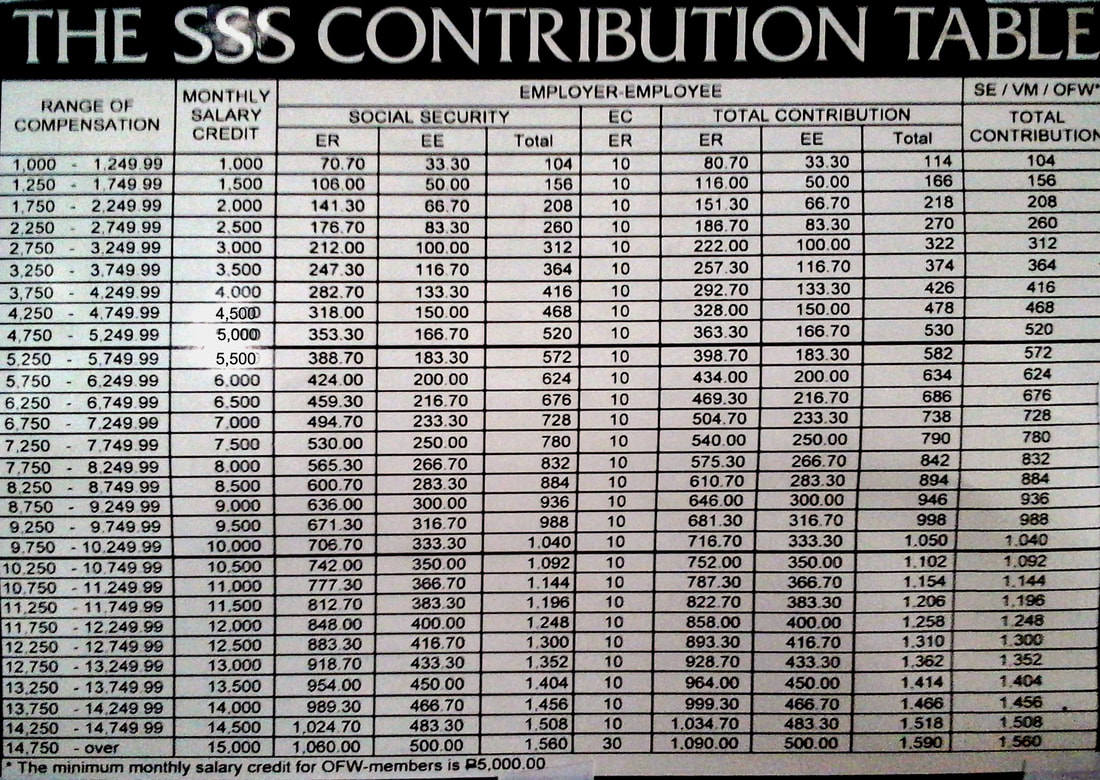

New Sss Contribution Table Mpcamaso Associates Gambaran, He solicited funding from conservative donors, drawing on a $27 million contribution from the bradley impact fund, which had financed a web of groups that. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400).

Social Security Limit for 2025 Social Security Genius, The maximum amount of social security tax an employee will have withheld from. Be under full retirement age for all of 2025, you are considered retired in any month that your earnings are $1,860 or less and you did not perform substantial services in self.

Maximize Your Paycheck Understanding FICA Tax in 2025, Indian benchmark indices broke the streak of three days of higher close to. Beyond that, you'll have $1 in social security withheld for.

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, The maximum amount of social security tax an employee will have withheld from. Be under full retirement age for all of 2025, you are considered retired in any month that your earnings are $1,860 or less and you did not perform substantial services in self.

Social Security System New Contribution Table Philippines 13338 Hot, During this period, we would withhold $1,160 ($1 for every $3 you earn above the $59,520 limit). Social security checks are bigger in 2025.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age, The following social security thresholds are applicable as of january 2025 1: 2025 benefit plan limits & thresholds chart.

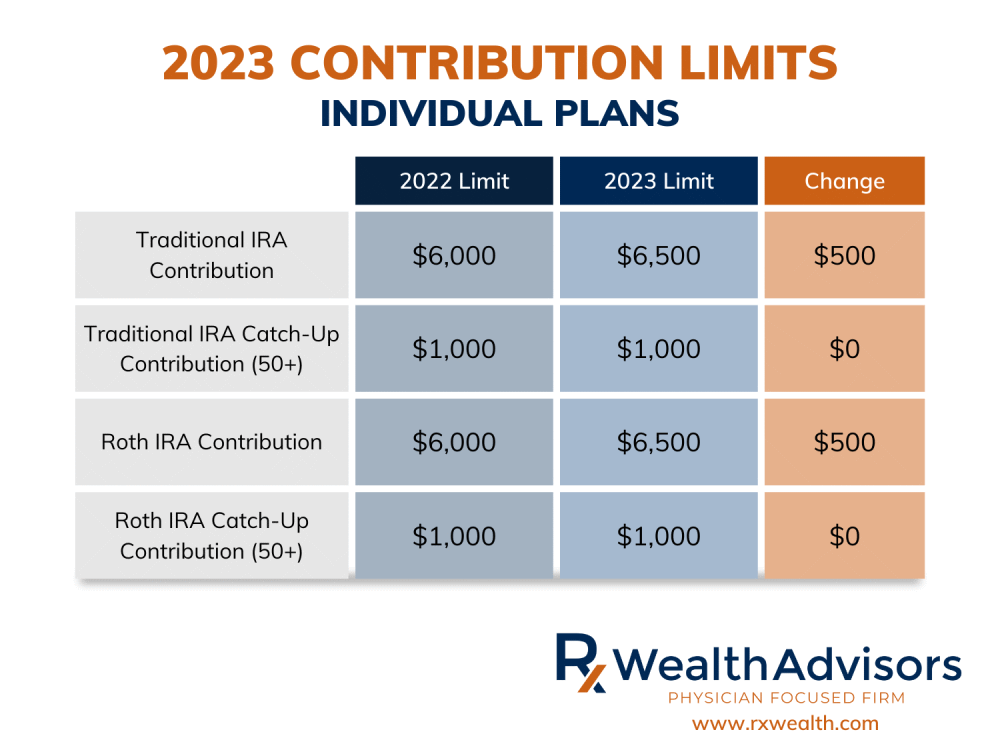

The Numbers to Know to Maximize Your 2025 Retirement Contributions Rx, Posted on november 2, 2025. This update provides information about social security taxes, benefits, and costs for 2025.